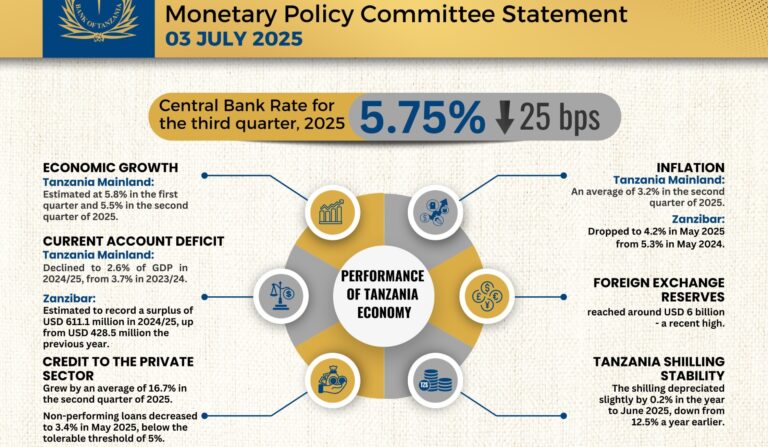

Dar es Salaam. The Bank of Tanzania (BoT) has lowered the Central Bank Rate (CBR) from 6.0 percent to 5.75 percent for the third quarter of the 2025 calendar year, a move expected to support ongoing economic recovery and maintain price stability.

Announcing the decision on Thursday July 3 in Dar es Salaam, the Governor of the BoT and Chairman of the Monetary Policy Committee, Mr Emmanuel Tutuba, said the adjustment reflects the Committee’s confidence in the current inflation outlook, which remains within the targeted band of 3–5 percent.

“This decision is based on the continued improvement in economic activity and containment of inflationary pressures,” said Mr Tutuba.

He added that the positive inflation trend is attributed to prudent implementation of monetary and fiscal policies, the onset of the harvest season, and the relative stability of the Tanzanian shilling.

The CBR, which serves as the benchmark rate for BoT’s transactions with commercial banks, guides short-term interest rates and is implemented within a ±2.0 percentage point margin.

The Central Bank will continue to pursue monetary policy aimed at ensuring that the 7-day interbank lending rate remains within the corridor of 3.75–7.75 percent.

According to the BoT, Tanzania’s economic performance continues to strengthen, driven by increased public infrastructure investment and rising private sector activity on the back of improving business conditions.

Governor Tutuba noted that the risks posed by global economic volatility to Tanzania’s economic prospects are relatively low, owing to the diversified nature of the economy and sound implementation of policy measures and programmes that support growth and resilience.

Responding to a question from the press, the Chairman of the Tanzania Bankers Association, Mr Theobald Sabi, said the reduction in the CBR could ease lending rates charged by commercial banks.

However, he pointed out that other factors, such as market forces and customer risk profiles, also influence the final lending rates.

The CBR for the fourth quarter of 2025 is expected to be announced in October, in line with the BoT’s monetary policy calendar.