Dar es Salaam. In 2025, the Office of the Treasury Registrar (OTR) crossed a critical threshold as it evolved from a largely supervisory institution into a strategic steward of public wealth, driving value, enforcing accountability, and modernising how Tanzania manages its investments.

Over the past year, the value of government investments under OTR oversight rose to Sh92.3 trillion underscoring the impact of ongoing reforms, according to the OTR.

Up from Sh86.3 trillion by June 2025, this increase reflected improved operational performance and more disciplined governance across public institutions and companies where the government holds minority shares, OTR reports indicate.

The rise in investment value was accompanied by a surge in financial returns, with Non-Tax Revenue collections reaching a historic Sh1.028 trillion by June 2025—68 percent higher than collections during the same period in 2024, and 34 percent above total collections in the 2023/24 financial year, according to OTR data.

Crucially, the revenue gains were not incidental. Dividends accounted for Sh603.4billion, while the statutory 15 percent contribution of gross revenues generated Sh363.4 billion supplemented by Sh61 billion from other sources.

These figures, as noted by Treasury Registrar Nehemiah Mchechu, point to the effectiveness of tighter monitoring mechanisms, closer engagement with boards and management, and expanded use of digital tools to track obligations in real time.

They also underscore a broader policy outcome: public enterprises are increasingly being held to the same standards of performance and accountability as private-sector firms, a shift that demanded more modern tools to track, monitor, and optimise state investments.

Digital oversight for a modern economy

Building on these reforms, perhaps the most transformative step in 2025 was the launch of the Public Investment Management System (PIMS) in August.

The system was officially inaugurated by former Vice-President Dr Philip Mpango at the CEOs Forum 2025 in Arusha, attended by over 650 board chairpersons and chief executives.

Dr Mpango highlighted that investments worth Sh92.3 trillion cannot be safeguarded through outdated systems and delayed reporting, emphasising the need for real-time, evidence-based monitoring.

PIMS provides real-time, data-driven oversight of public investments, enabling faster decision-making, early identification of risks, and policy interventions informed by evidence, according to OTR reports.

Financial outcomes, however, tell only part of the story as beneath the numbers lies a sustained governance reform agenda aimed at correcting structural weaknesses that have historically constrained public institutions.

In 2025, OTR intensified the use of Key Performance Indicators (KPIs) and formalised board performance evaluations to ensure that institutional results are measurable, transparent, and aligned with national priorities, Mr Mchechu noted.

One visible result of this approach has been the steady reduction in institutions operating without boards of directors—a long-standing governance gap.

The number declined from 52 in 2019/20 to 28 in 2024/25, representing a 46 percent improvement, according to OTR.

This shift has strengthened oversight, clarified accountability lines, and improved decision-making quality across the public enterprise landscape.

Governance reforms also extended to companies in which the government holds minority shares.

Through a Minority Interest Companies forum held from March 26 to 28, 2025, at the Mwalimu Nyerere Leadership School in Kibaha, Pwani Region, that brought together 125 participants, OTR launched an enhanced Directors’ Guideline, reinforcing fiduciary responsibility, ethical conduct, and performance oversight.

Mr Mchechu emphasised that minority shareholding must not translate into weak influence where public resources are at stake.

Strategic expansion in priority sectors

Alongside internal reforms, the government expanded its strategic footprint in sectors critical to national development.

In mining, state participation through OTR increased from four companies in 2019/20 to 12 by 2025, a 200 percent rise, with negotiations underway for 10 additional agreements, according to OTR data.

This expansion reflects a deliberate policy choice to secure fair value from natural resources while strengthening governance and transparency in extractive industries.

The financial sector saw a similarly strategic move with the government’s acquisition of a 10 percent stake in the Tanzania Cooperative Bank.

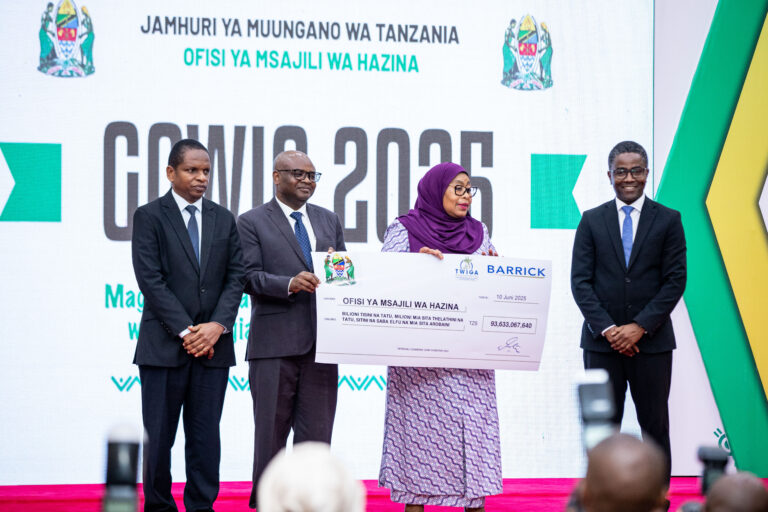

Officially launched on April 28, 2025, by President Samia Suluhu Hassan, the bank was designed to address persistent financing gaps in agriculture and cooperative societies.

With a total capital of Sh58 billion, the bank’s ownership structure—51 percent cooperative societies, 20 percent CRDB Bank, 19 percent private investors, and 10 percent OTR—positions it as a hybrid institution aligned with inclusive growth objectives.

The government’s Sh5.8 billion contribution signalled both financial commitment and policy intent, Mr Mchechu explained during the launch ceremony.

Leadership as a reform multiplier

Recognising that systems and policies are only as effective as the people who implement them, OTR placed strong emphasis on leadership development.

In July 2025, 114 chief executive officers underwent the CEO Induction Programme, conducted in collaboration with the UONGOZI Institute, focusing on modern management practices, accountability, transparency, and effective service delivery.

The session built on a similar programme held in October 2024, which involved 111 participants, demonstrating the government’s sustained commitment to strengthening leadership in public institutions, OTR reported.

Treasury Registrar Mchechu consistently framed leadership as the key player of reform, urging executives to adapt their mindsets to evolving governance standards.

This message was reinforced by Prof Kitila Mkumbo, Minister of State for Planning and Investment, and Mr Juma Mkomi, Permanent Secretary in the President’s Office (Public Service Management), both of whom emphasised strict adherence to legal frameworks and prudent use of public resources as prerequisites for sustainable development.

Credibility, recognition, and institutional values

The cumulative impact of these reforms was reflected in national recognition.

In December 2025, OTR was awarded second place in the Independent Government Departments category at the NBAA Best Presented Financial Statements Awards 2024.

The accolade affirmed the Office’s commitment to professionalism, transparency, and compliance with financial reporting standards—qualities essential to maintaining public trust, Mr Hassan Mohamed, Director of Finance and Accounting at OTR, noted.

Yet 2025 also brought a sobering reminder of the human dimension of public service.

The passing of Ms Miriam Mnzava, Chief Accountant I, on November 28, 2025, was deeply felt across the institution.

Her dedication and professionalism embodied the values underpinning OTR’s reform journey, reinforcing the reality that institutional performance ultimately rests on individual commitment.

A turning point in public investment management

Taken together, the events of 2025 suggest that OTR is moving beyond traditional custodianship toward active value creation.

By aligning financial performance with governance reform, digital oversight, and leadership development, the Office has strengthened its role as a central pillar in Tanzania’s public investment architecture.

The challenge ahead lies in sustaining momentum—ensuring that the gains recorded in 2025 translate into long-term institutional resilience and inclusive national development.

Dar es Salaam. In 2025, the Office of the Treasury Registrar (OTR) crossed a critical threshold as it evolved from a largely supervisory institution into a strategic steward of public wealth, driving value, enforcing accountability, and modernising how Tanzania manages its investments.

Over the past year, the value of government investments under OTR oversight rose to 92.3 tril/-, underscoring the impact of ongoing reforms, according to the OTR.

Up from 86.3/- tril by June 2025, this increase reflected improved operational performance and more disciplined governance across public institutions and companies where the government holds minority shares, OTR reports indicate.

The rise in investment value was accompanied by a surge in financial returns, with Non-Tax Revenue collections reaching a historic 1.028 tril/- by June 2025—68 percent higher than collections during the same period in 2024, and 34 percent above total collections in the 2023/24 financial year, according to OTR data.

Crucially, the revenue gains were not incidental. Dividends accounted for 603.4bill/-, while the statutory 15 percent contribution of gross revenues generated 363.4 bill/-, supplemented by 61 bill/- from other sources.

These figures, as noted by Treasury Registrar Nehemiah Mchechu, point to the effectiveness of tighter monitoring mechanisms, closer engagement with boards and management, and expanded use of digital tools to track obligations in real time.

They also underscore a broader policy outcome: public enterprises are increasingly being held to the same standards of performance and accountability as private-sector firms, a shift that demanded more modern tools to track, monitor, and optimise state investments.

Digital oversight for a modern economy

Building on these reforms, perhaps the most transformative step in 2025 was the launch of the Public Investment Management System (PIMS) in August.

The system was officially inaugurated by former Vice-President Dr Philip Mpango at the CEOs Forum 2025 in Arusha, attended by over 650 board chairpersons and chief executives.

Dr Mpango highlighted that investments worth Sh92.3 trillion cannot be safeguarded through outdated systems and delayed reporting, emphasising the need for real-time, evidence-based monitoring.

PIMS provides real-time, data-driven oversight of public investments, enabling faster decision-making, early identification of risks, and policy interventions informed by evidence, according to OTR reports.

Financial outcomes, however, tell only part of the story as beneath the numbers lies a sustained governance reform agenda aimed at correcting structural weaknesses that have historically constrained public institutions.

In 2025, OTR intensified the use of Key Performance Indicators (KPIs) and formalised board performance evaluations to ensure that institutional results are measurable, transparent, and aligned with national priorities, Mr Mchechu noted.

One visible result of this approach has been the steady reduction in institutions operating without boards of directors—a long-standing governance gap.

The number declined from 52 in 2019/20 to 28 in 2024/25, representing a 46 percent improvement, according to OTR.

This shift has strengthened oversight, clarified accountability lines, and improved decision-making quality across the public enterprise landscape.

Governance reforms also extended to companies in which the government holds minority shares.

Through a Minority Interest Companies forum held from March 26 to 28, 2025, at the Mwalimu Nyerere Leadership School in Kibaha, Pwani Region, that brought together 125 participants, OTR launched an enhanced Directors’ Guideline, reinforcing fiduciary responsibility, ethical conduct, and performance oversight.

Mr Mchechu emphasised that minority shareholding must not translate into weak influence where public resources are at stake.

Strategic expansion in priority sectors

Alongside internal reforms, the government expanded its strategic footprint in sectors critical to national development.

In mining, state participation through OTR increased from four companies in 2019/20 to 12 by 2025, a 200 percent rise, with negotiations underway for 10 additional agreements, according to OTR data.

This expansion reflects a deliberate policy choice to secure fair value from natural resources while strengthening governance and transparency in extractive industries.

The financial sector saw a similarly strategic move with the government’s acquisition of a 10 percent stake in the Tanzania Cooperative Bank.

Officially launched on April 28, 2025, by President Samia Suluhu Hassan, the bank was designed to address persistent financing gaps in agriculture and cooperative societies.

With a total capital of Sh58 billion, the bank’s ownership structure—51 percent cooperative societies, 20 percent CRDB Bank, 19 percent private investors, and 10 percent OTR—positions it as a hybrid institution aligned with inclusive growth objectives.

The government’s Sh5.8 billion contribution signalled both financial commitment and policy intent, Mr Mchechu explained during the launch ceremony.

Leadership as a reform multiplier

Recognising that systems and policies are only as effective as the people who implement them, OTR placed strong emphasis on leadership development.

In July 2025, 114 chief executive officers underwent the CEO Induction Programme, conducted in collaboration with the UONGOZI Institute, focusing on modern management practices, accountability, transparency, and effective service delivery.

The session built on a similar programme held in October 2024, which involved 111 participants, demonstrating the government’s sustained commitment to strengthening leadership in public institutions, OTR reported.

Treasury Registrar Mchechu consistently framed leadership as the key player of reform, urging executives to adapt their mindsets to evolving governance standards.

This message was reinforced by Prof Kitila Mkumbo, Minister of State for Planning and Investment, and Mr Juma Mkomi, Permanent Secretary in the President’s Office (Public Service Management), both of whom emphasised strict adherence to legal frameworks and prudent use of public resources as prerequisites for sustainable development.

Credibility, recognition, and institutional values

The cumulative impact of these reforms was reflected in national recognition.

In December 2025, OTR was awarded second place in the Independent Government Departments category at the NBAA Best Presented Financial Statements Awards 2024.

The accolade affirmed the Office’s commitment to professionalism, transparency, and compliance with financial reporting standards—qualities essential to maintaining public trust, Mr Hassan Mohamed, Director of Finance and Accounting at OTR, noted.

Yet 2025 also brought a sobering reminder of the human dimension of public service.

The passing of Ms Miriam Mnzava, Chief Accountant I, on November 28, 2025, was deeply felt across the institution.

Her dedication and professionalism embodied the values underpinning OTR’s reform journey, reinforcing the reality that institutional performance ultimately rests on individual commitment.

A turning point in public investment management

Taken together, the events of 2025 suggest that OTR is moving beyond traditional custodianship toward active value creation.

By aligning financial performance with governance reform, digital oversight, and leadership development, the Office has strengthened its role as a central pillar in Tanzania’s public investment architecture.

The challenge ahead lies in sustaining momentum—ensuring that the gains recorded in 2025 translate into long-term institutional resilience and inclusive national development.