Dar es Salaam. The government has launched the Samia Infrastructure Bond, a groundbreaking financial initiative aimed at raising Sh150 billion to improve rural roads across Tanzania.

The bond will be managed by the Tanzania Rural and Urban Roads Agency (TARURA), with the goal of addressing infrastructure challenges in rural areas while creating new economic opportunities and jobs.

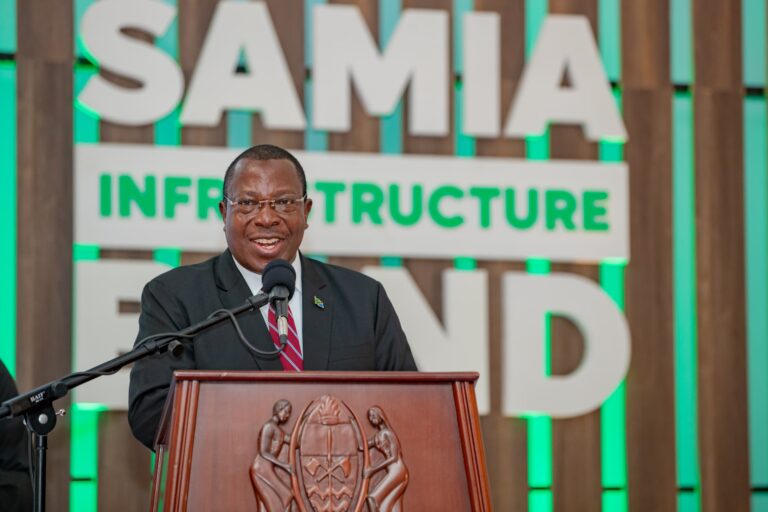

The launch was graced by the Vice President, Dr. Philip Mpango here in the city on Friday, November 29, 2024.

Dr Mpango emphasized that the bond is designed to tackle the persistent issues of budget constraints and delayed payments to contractors, which have slowed the implementation of road projects.

He urged TARURA to leverage technological innovations in the design and construction of roads and bridges to ensure that projects are completed on time and within budget.

Dr Mpango called on the Ministry of Regional Administration and Local Government to partner with CRDB Bank to raise public awareness about the bond’s benefits and investment opportunities.

He highlighted that this bond represents a unique economic opportunity for Tanzanians to actively participate in the country’s development while earning attractive returns.

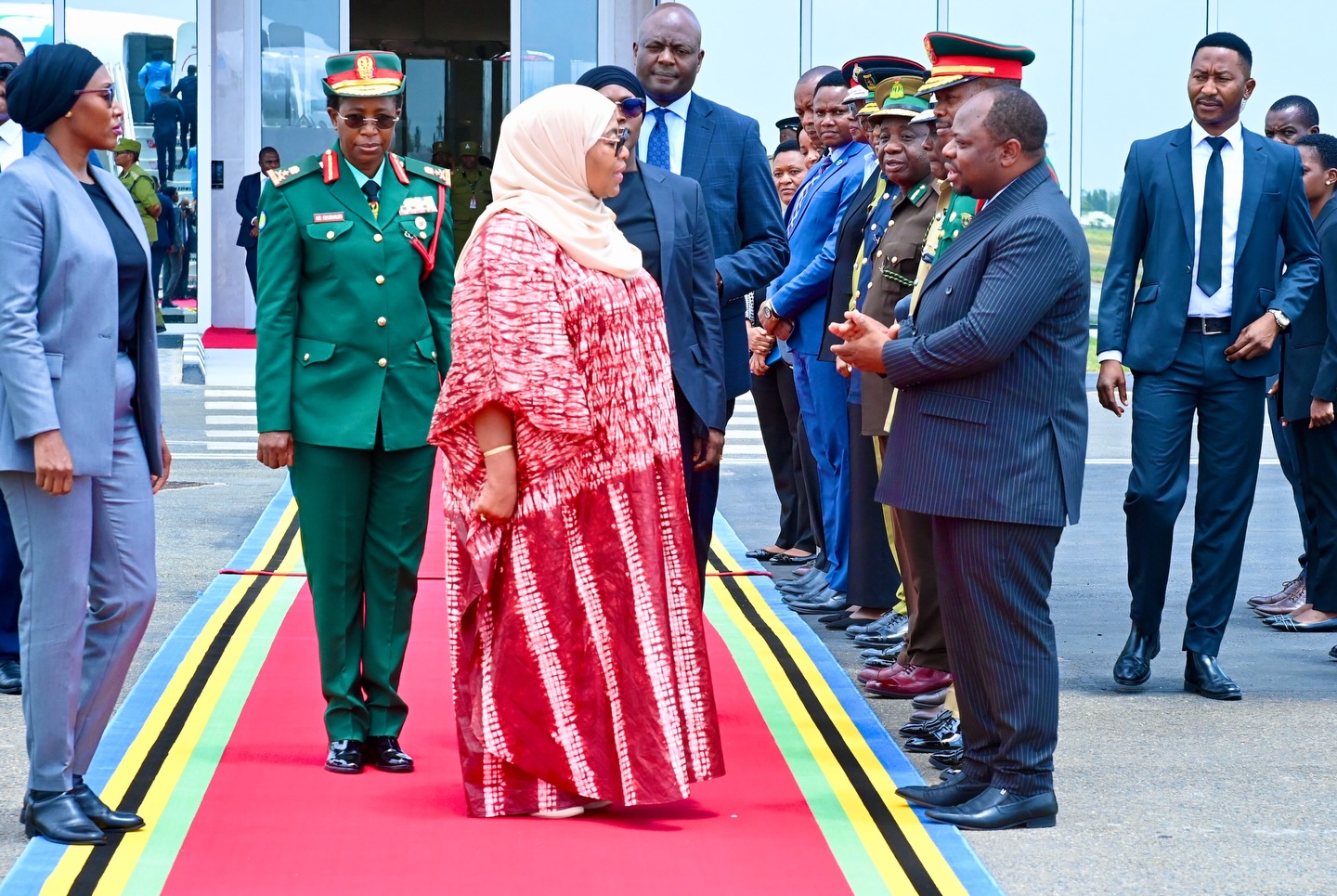

Support from key government officials

Minister of State in the President’s Office, Mohamed Mchengerwa, outlined how the funds from the bond will be used to connect district, ward, and village roads, unlocking significant economic potential in rural areas.

This infrastructure development, he noted, would also create jobs and stimulate local economies.

Deputy Minister for Works, Mr Godfrey Kasekenya, pledged to collaborate closely with contractors to ensure the high-quality execution of all projects funded by the bond.

The Deputy Minister for Finance, Mr Hamad Chande, expressed confidence that the bond would offer a sustainable financial solution to the challenges faced by rural road development.

Mr Nicodemus Mkama, the CEO of the Capital Markets and Securities Authority (CMSA), praised Tanzania’s stable capital markets and emphasized the bond’s role as a secure investment option for both domestic and international investors.

Bond sale details

The Samia Bond is now available for purchase through CRDB Bank, the Dar es Salaam Stock Exchange (DSE), and authorized CRDB agents.

Investors can buy the bond with a minimum investment of Sh500,000 and will receive an annual interest rate of 12 percent.

The sale period runs until January 17, 2025, providing a limited window for citizens and investors to participate in this transformative infrastructure project.