Dar es Salaam. Visa, a global leader in digital payments, has officially opened its new office in Tanzania, marking a significant milestone in its expansion across East Africa and reinforcing its commitment to financial inclusion and digital transformation in the region.

The announcement was made during the inaugural Visa Day Tanzania 2025, held in Dar es Salaam under the theme Shaping the Future of Payments in Tanzania.

The event convened key players from across the financial services ecosystem, including regulators, banks, fintechs, mobile network operators and development partners, and served as a platform for discussions on the evolving payments landscape and the role of collaboration in advancing innovation.

The new office in Tanzania will act as a regional hub, supporting Visa’s operations in Uganda, Rwanda and Burundi. It will be led by Mr Victor Makere, a Tanzanian national with in-depth knowledge of the financial sector in the region, who has been appointed as Country Manager.

“Tanzania is one of the most dynamic and promising markets in Africa when it comes to digital payments,” said Mr Michael Berner, Visa’s Head of Southern and Eastern Africa.

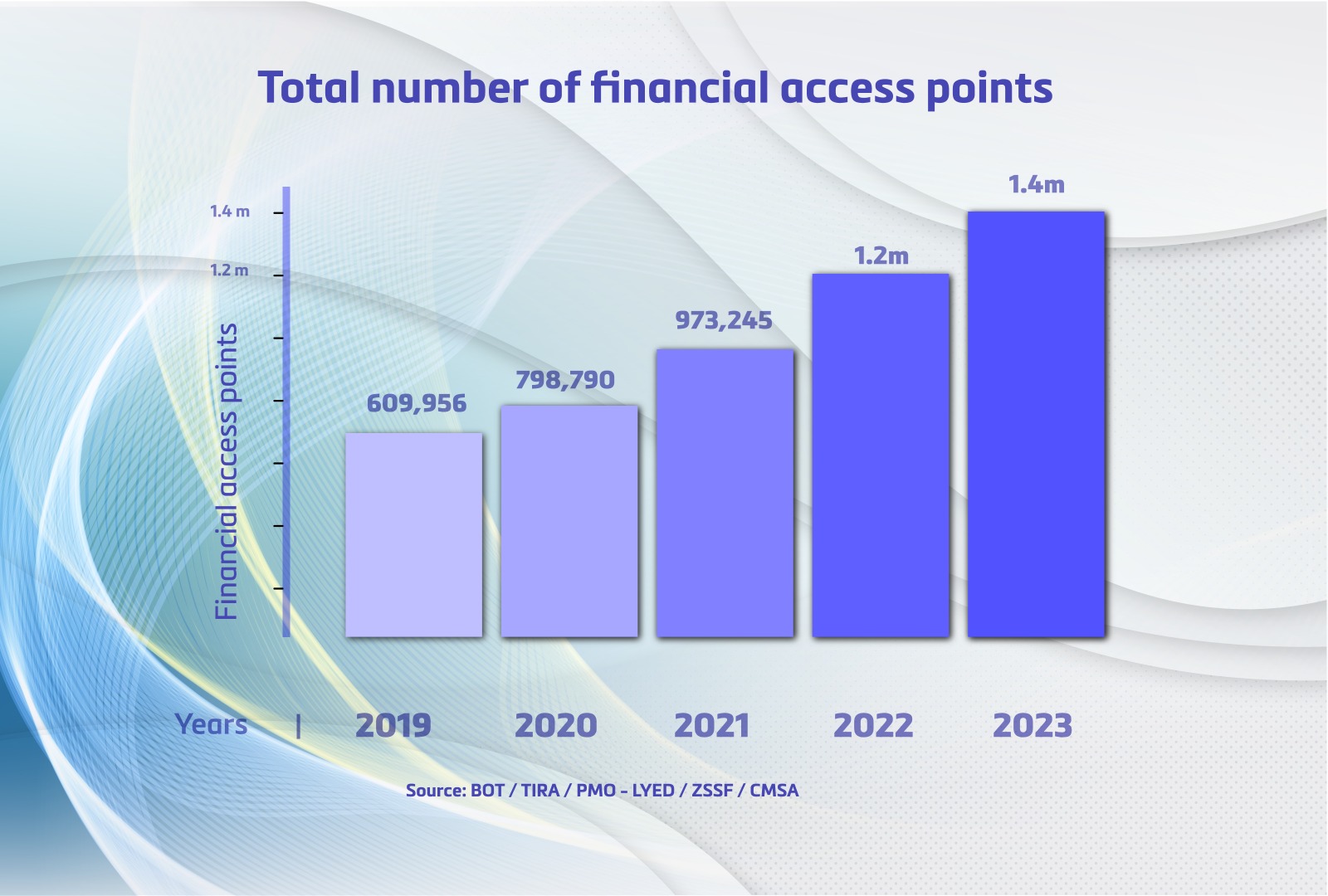

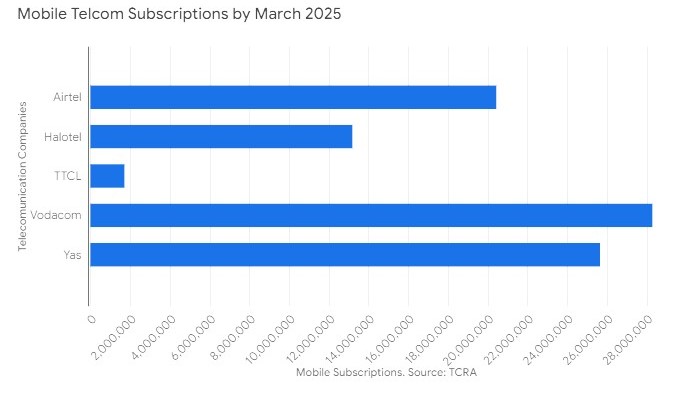

He pointed to the country’s growing mobile and internet penetration, a vibrant small and medium-sized enterprise (SME) sector, and a concerted national push for financial inclusion as indicators of strong potential for digital financial growth.

Bank of Tanzania Governor, Mr Emmanuel Tutuba, officiated the event and underscored the critical role of digital payment technologies in supporting economic development and enhancing financial sector resilience.

During the event, Visa presented its latest Value of Acceptance study, which highlights the economic and social advantages of adopting digital payments in Tanzania.

The study notes that the expansion of digital payment infrastructure can unlock efficiency, promote transparency and improve access to financial services, especially among underserved populations.

As part of its Tanzania growth strategy, Visa has initiated several projects aimed at fostering innovation and expanding the reach of its services.

These include partnerships with government entities to digitise public service payments and collections, thereby improving convenience and accountability in revenue management.

In the tourism sector, Visa has been instrumental in enabling online visa payments and in digitising access to national parks and travel insurance platforms in Zanzibar, which are expected to streamline the visitor experience and promote tourism receipts.

Visa is also investing in the agricultural sector, with targeted initiatives to digitise payments to smallholder farmers and fishers.

These groups represent more than half of Tanzania’s workforce and contribute around 27 percent of the country’s gross domestic product.

The aim is to increase financial access and improve income security for rural communities.

In addition, Visa is collaborating with banks and fintech companies to enhance the security of digital transactions through tokenisation, which replaces sensitive payment information with secure digital identifiers, thereby reducing the risk of fraud and data breaches.

To strengthen its financial inclusion agenda, Visa has partnered with the African Confederation of Co-operative Savings and Credit Associations (ACCOSCA) to improve access to digital financial tools in both Kenya and Tanzania.

The initiative particularly targets women, youth and marginalised communities who remain outside the formal financial system.

Another key component of Visa’s strategy is the integration of mobile money into its global payment infrastructure.

In collaboration with Vodacom Tanzania, Visa has introduced the M-PESA Visa virtual card, which allows users to make online payments both locally and internationally using funds stored in their M-PESA wallets.

This solution eliminates the need for a conventional bank account, thereby extending secure online payment capabilities to millions of mobile money users.

Visa’s establishment of a regional office in Dar es Salaam is part of a broader effort to increase its physical presence in East Africa and foster partnerships that will advance inclusive digital economies.

Operating in over 200 countries and territories, the company maintains its mission to connect the world through secure, innovative, and accessible payment solutions that benefit individuals, businesses and governments alike.