Dar es Salaam. Tanzania is experiencing a financial revolution, with a dramatic increase in the number of access points for formal financial services.

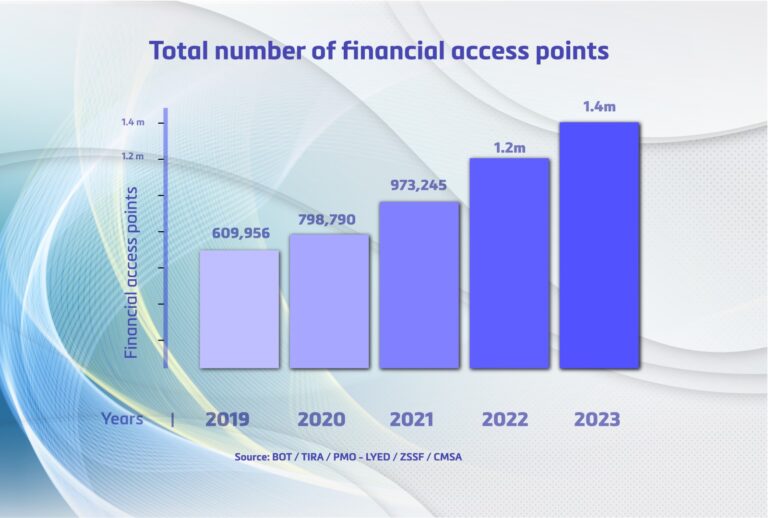

Going by the first edition of the Annual Financial Inclusion Report 2023, the number of financial service access points in the country has more than doubled in just five years, rising by 129.9 percent from 609,956 in 2019 to an impressive 1.4 million in 2023.

This surge is not just a statistic—it marks a pivotal shift that is reshaping the economic landscape of Tanzania, particularly for small businesses and micro-entrepreneurs.

Mr Emmanuel Tutuba, the Bank of Tanzania (BoT) Governor stated in the report: “It is my conviction that enhanced collaboration and unfettered consultative engagements between the public and private implementing institutions are a precursor to accelerating financial inclusion in Tanzania.”

Mr Tutuba, who also doubles as the chairperson of the National Council for Financial Inclusion, exuded his optimism that their efforts to enhance financial inclusion will continue to contribute to sustainable economic growth.

This growth will be anchored on the integrity and stability of the financial sector, balanced with effective consumer protection that reinforces public confidence and trust in using formal financial products and services.

At the heart of this transformation are the government’s efforts to support financial inclusion and create an enabling environment for businesses, particularly Micro, Small, and Medium Enterprises (MSMEs).

These efforts are particularly crucial, as MSMEs make up a significant portion of Tanzania’s economy, driving job creation, innovation, and local economic development.

However, for these businesses to thrive, access to formal financial services—such as credit, insurance, and investment opportunities—is essential.

According to the national demand-side survey (FinScope), in 2023, the percentage of Tanzanians living within a five-kilometer radius of a financial service access point increased to 89 percent, up from 86 percent in 2017.

Further, under the period of review, usage of formal financial services also increased from 65 percent to 76 percent, largely driven by increased uptake of formal financial services and products, including banking and mobile services.

This rise in formal financial service usage is a testament to the growing inclusivity of the Tanzanian financial system, with more people benefiting from its reach.

A major driver of this growth in access to financial services has been the expansion of banking services, which have tripled in the past five years.

The number of access points for banking services, including bank branches, agents, and leasing companies, soared to 107,238 in 2023 from just 29,371 in 2019.

This was largely driven by the increased use of bank agents, who now account for nearly 99 percent of all banking service access points.

The spread of these services has opened doors for small business owners who previously struggled to access formal banking facilities.

But it’s not just traditional banking that is driving change.

The microfinance sector has also experienced remarkable growth.

Microfinance access points surged from 6,241 in 2019 to 51,253 by the end of 2023.

This growth can be attributed to the formalization of the microfinance subsector in 2018, which helped create a more efficient and accessible licensing process for microfinance providers.

The increased demand for micro-credit facilities, particularly in rural areas, is helping to fuel this boom.

One of the most significant developments in Tanzania’s financial landscape is the rise of digital financial services, which have revolutionized the way businesses and individuals access and use financial services.

The number of Automated Teller Machines (ATMs), mobile money agents, and merchant points of sale (POS) systems has grown substantially, reaching 1.25 million in 2023 compared to just 573,444 in 2019.

An economist from Mzumbe University, Dr Daud Ndaki told The BizLens on Monday that with the advancement in science and technology, digital payments are increasingly becoming the norm, offering businesses, especially those in remote areas, a fast, efficient, and secure way to handle transactions.

It goes without saying this convenience has made it easier for small entrepreneurs to expand their customer base, streamline operations, and access capital.

“The increase in financial access provides room for convenience and simplicity. One will not have to travel long in search of financial services and thus save time,” underscored Dr Ndaki.

For small businesses, particularly those in sectors such as agriculture, retail, and manufacturing, access to formal financial services is not just a convenience—it’s a lifeline.

The impact is already visible: small businesses are thriving, creating jobs, and contributing to Tanzania’s overall economic growth.

The financial inclusion drive is helping reduce poverty and inequality, empowering individuals who may have once been excluded from formal financial systems to actively participate in the economy.

Women, in particular, are benefiting from these changes, with more women-owned businesses gaining access to credit and financial tools that were previously out of reach.

Dr Tobias Swai, the Head of the Finance Department at the University of Dar es Salaam’s Business School, told The BizLens over the weekend that the increase in financial service access points provides room for an increase in financial literacy.

“ As more Tanzanians gain access to formal financial services, the opportunity to enhance financial knowledge and decision-making grows, benefiting both individuals and businesses,” he said.

Insurance services have also seen a notable increase, with access points rising to 1,452 in 2023, up from 795 in 2019.

The growth of insurance, particularly in digital platforms and the expansion of Bancassurance, has provided new opportunities for Tanzanians to protect their businesses and assets, fostering a sense of financial security that is essential for sustainable growth.

But the expansion of financial access points goes beyond just providing services—it’s about fostering an inclusive economy.

The Tanzanian government has been actively working to create a financial ecosystem that encourages entrepreneurship and supports the growth of MSMEs.

The country’s regulatory reforms, including guidelines for digital platforms and Bancassurance, have all helped stimulate the sector’s growth.

Financial inclusion is becoming a catalyst for sustainable economic development, as it allows businesses to thrive in an inclusive financial ecosystem.

With easier access to credit, they can invest in equipment, hire additional workers, or expand their operations.

Meanwhile, the rise of digital platforms has enabled entrepreneurs to reach more customers, both locally and internationally, while reducing operational costs.

As Tanzania continues to make strides in financial inclusion, it is poised to become a model for other countries in the region.

With its forward-thinking policies, regulatory reforms, and the embrace of digital technologies, Tanzania is showing the world how financial inclusion can be a powerful driver of economic growth and social development.