Dar es Salaam. The Tanzanian shilling has made a remarkable rebound against the US dollar in 2024, approaching the end of the year on a strong note.

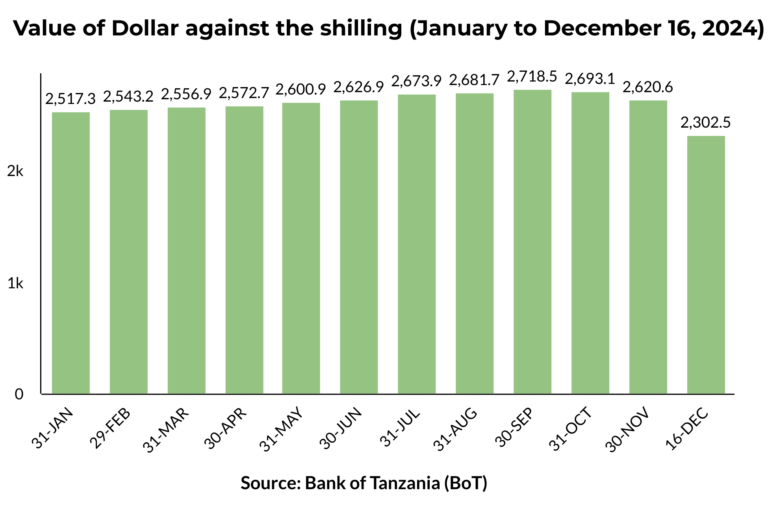

As of today, December 16, the average exchange rate stands at Sh2,302.5 to the US dollar, marking a substantial recovery from Sh2,517.3 at the beginning of the year.

Analysts say the shilling’s appreciation is not only a sign of improved economic stability, but also a key driver for growth, especially in the manufacturing sector and other import-dependent industries.

This recovery follows a period of significant fluctuations, with the shilling hitting a low of Sh2,718.5 by the end of September.

Currently, the strengthened shilling represents a major turning point for the Tanzanian economy, offering new opportunities for businesses, consumers, and the broader market.

At the height of the shilling’s depreciation earlier in the year, many businesses were burdened by high import costs, which were ultimately passed on to consumers in the form of rising prices.

The Shilling’s fluctuations: A year of challenges and recovery

In the first half of 2024, the Tanzanian shilling experienced steady depreciation, climbing from Sh2,517.3 in January to Sh2,600.9 by the end of May.

The currency’s decline was further exacerbated by a spike in black market rates, where the dollar traded as high as Sh3,000 in some areas.

This was a reflection of rising demand for foreign currency, particularly in sectors reliant on imports, coupled with the broader global economic challenges, including supply chain disruptions and inflationary pressures.

However, by mid-year, the Tanzanian government stepped in with decisive actions aimed at stabilizing the currency.

In June, Finance Minister Dr Mwigulu Nchemba issued a landmark directive to curb dollarisation and restore confidence in the Tanzanian shilling, mandating that all domestic transactions be conducted in shillings.

This intervention, along with increased foreign exchange reserves and improving export performance, helped restore stability to the currency.

By October, the shilling had begun to recover, trading at an average of Sh2,693.1, and continued its upward trend throughout November and December, reaching Sh2,302.5 by Monday (today).

This marked a significant improvement from the earlier lows and has sparked optimism for the year ahead.

Voices on the shift

Mr Akida Mnyenyelwa, the Director of Policy and Advocacy at the Confederation of Tanzania Industries (CTI), called the shilling’s recovery a “huge relief” for the manufacturing sector.

He emphasized that the appreciation would reduce the cost of importing raw materials and spare parts, which had previously been a significant burden on manufacturers.

He told The BizLens on Sunday that lower costs for these inputs will ultimately help to lower the prices of final goods, benefiting both businesses and consumers alike.

“This is a huge relief for us in the manufacturing industry,” Mr Mnyenyelwa underscored.

“Previously, we had to import raw materials at high costs, and the final consumer was the one who bore the burden.

“Now, with a stronger shilling, we’ll see a reduction in those costs, and it will certainly foster faster growth within the manufacturing sector.”

His sentiments were echoed by Dr Tobias Swai, the Head of the Finance Department at the University of Dar es Salaam’s Business School.

He remarked that cheaper imports would boost Tanzania’s purchasing power, enabling businesses to invest more in essential goods like machinery and technology.

“Any country would wish to have a strong currency,” Dr Swai told The BizLens on Sunday.

He went on to add: “With a stable shilling, imports will become cheaper, which means we can buy more and invest in the imports necessary for growth.”

BoT’s role and global factors behind the shift

The Bank of Tanzania (BoT) Governor, Mr Emmanuel Tutuba, recently attributed the shilling’s steady appreciation to a combination of domestic efforts and favorable global economic factors.

He pointed to the stabilization of the US economy and lower interest rates in the United States as key elements that have driven global investors to diversify into other markets, including Tanzania.

This shift has resulted in a higher supply of US dollars on the global market, contributing to the shilling’s strength.

“As the US economy stabilizes and interest rates remain low, investors have been seeking opportunities in other markets, leading to a higher supply of US dollars on the global market,” said Governor Tutuba.

“This has been a key factor behind the shilling’s steady appreciation.”

The road to recovery: What’s next for the Tanzanian Shilling?

With the shilling strengthening throughout the final quarter of 2024, projections for 2025 are optimistic.

The government’s policy interventions, combined with improving export earnings and remittances from the Tanzanian diaspora, are expected to sustain the positive trend in the coming year.

However, challenges remain. Global economic uncertainties, including potential geopolitical risks, commodity price fluctuations, and climate-related impacts on agriculture, continue to pose risks.

Nevertheless, the positive trajectory of the Tanzanian shilling has provided a sense of stability and relief to the country’s businesses and consumers.