Dar es Salaam. Agriculture remains Tanzania’s economic maintsay.

However, new data from the Bank of Tanzania (BoT) indicate that the financial and insurance sector is emerging as a major driver of economic expansion.

An analysis by The BizLens highlights a shift towards a more diversified economy, with financial and insurance services’ share in the gross domestic product (GDP) growth rising steadily annually in the past five years.

Latest data released by BoT shows that financial and insurance was the second-largest contributor to GDP in 2024, up from the lowest position in 2020.

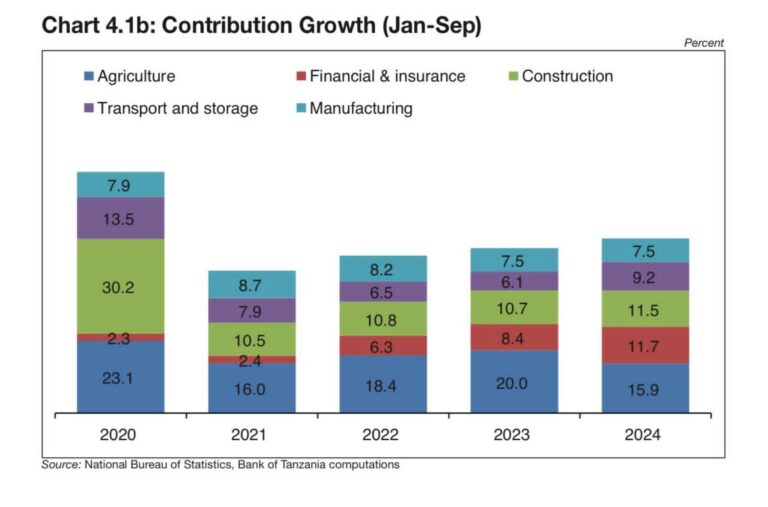

A stacked bar chart illustrating sectoral contributions in 2024 shows a more balanced distribution of colours compared to the stark disparities observed in 2020.

Agriculture led with a 15.9 percent contribution, followed by financial and insurance services at 11.7 percent, a significant rise from 2.3 percent in 2020.

Construction closely followed at 11.5 percent, while transport and storage contributed 9.2 percent, and manufacturing accounted for 7.5 percent.

The financial and insurance sector has shown consistent growth, rising from 2.3 percent in 2020 to 2.4 percent in 2021, 6.3 percent in 2022, 8.4 percent in 2023, and now 11.7 percent in 2024.

Meanwhile, agriculture and construction, previously dominant sectors, have seen a decline.

Agriculture’s contribution fell from 23.1 percent in 2020 to 15.9 percent in 2024, while construction dropped from 30.2 percent in 2020 to 11.5 percent in 2024.

Transport and storage also saw a decline, from 13.5 percent in 2020 to 9.2 percent in 2024, while manufacturing remained relatively stable, decreasing slightly from 7.9 percent to 7.5 percent.

The rapid rise of the financial and insurance sector aligns with its exponential growth in recent years.

In 2024, Tanzania had 33 banks, with total profits exceeding the Sh2 trillion mark for the first time in the country’s history.

The insurance industry also recorded a 19.11 percent growth, driven by new market entrants and an expanding range of insurance solutions.

An unaudited report by the Association of Tanzania Insurers (ATI) shows that Gross Premium Written (GPW) rose to Sh1.47 trillion in 2024, up from Sh1.24 trillion in 2023.

The expansion of financial and insurance services reflects Tanzania’s efforts to enhance financial inclusion and improve banking services.

This trend underscores the increasing reliance on modern financial services and the impact of policy interventions in diversifying the economy beyond agriculture.

The decline agriculture’s contribution in 2024 was attributed to structural adjustments in the economy, though agriculture remains crucial.

Cashew nut production played a significant role in agricultural performance in 2024, with output reaching a historic high.

Production increased by 115,900 metric tonnes, rising from 189,114 metric tonnes in the previous season to 305,014 metric tonnes.

Export earnings from cashews also grew, reaching $227.109 million (Sh581.40 billion), up from $162.363 million (Sh415.65 billion) in 2023.

The introduction of the online auction system by the Tanzania Mercantile Exchange was instrumental in sustaining higher prices for farmers.

“Procurement of cashew nuts reached its highest level in five years, with farmers benefiting from improved prices due to the online auction system introduced by the Tanzania Mercantile Exchange,” the BoT reported.

According to BoT’s Monetary Policy Statement released in February, both Mainland Tanzania and Zanzibar exhibited steady economic performance in 2024.

Mainland Tanzania recorded 5.6 percent growth in the first three quarters of the year, with an estimated 5.7 percent growth in the fourth quarter.

The projection for the annual growth rate stand at 5.6 percent, according to the central bank.

This would surpass the initial projection of 5.4 percent, driven by agriculture, finance and insurance, transport, and construction.

“Tourism, which spans multiple sectors, also contributed to [three quarters’] growth through transport and storage, as well as accommodation and restaurants. A stable power supply, favourable weather conditions for agriculture, an improved business environment, and prudent policies supported overall economic performance,” the BoT stated.

Zanzibar’s Economic Performance

Meanwhile, Zanzibar recorded strong economic growth, with a 7 percent increase in the first three quarters of 2024 and an estimated 7.2 percent for the full year.

The island’s key growth drivers were tourism, livestock, and construction.

The recovery of tourism significantly boosted transport, accommodation, and restaurant services, reinforcing Zanzibar’s economic stability.