Dodoma. As preparations for the 2025/26 fiscal year intensify, the government is taking steps to ensure a well-organised and efficient budget.

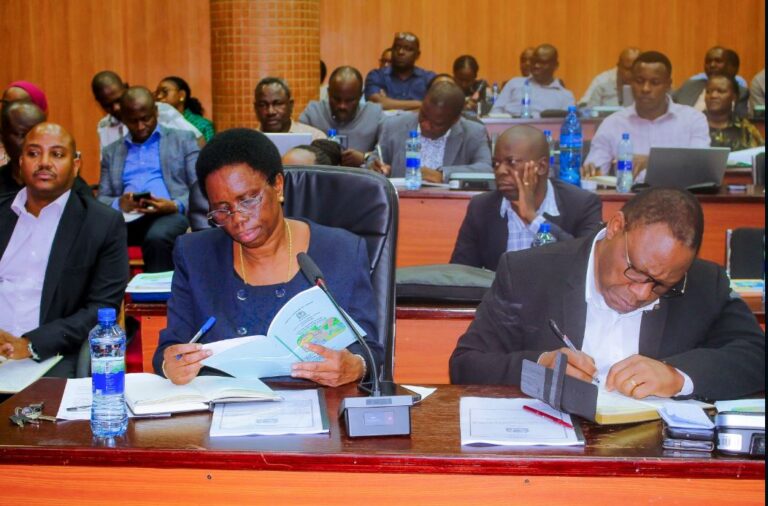

Over the weekend, the Deputy Permanent Secretary in the Ministry of Finance, Jenifa Christian Omolo, officiated a Budget and Planning Analysis Meeting here in the city.

The gathering brought together Regional Administrative Secretaries, Municipal Directors, and Budget Officers from various regions.

The purpose of the meeting was to provide a comprehensive review of the national budget framework.

By focusing on strategic resource allocation, the government aims to align the fiscal plan with Tanzania’s economic and development priorities.

This approach is expected to guide decision-making and ensure that public funds are used effectively to support the country’s long-term goals.

The deliberations of the weekend meeting focused on fostering a unified understanding of how financial resources will be channelled into priority areas to achieve short, medium, and long-term national objectives, as outlined in the 2025/26 Budget Guidelines, the Third National Five-Year Development Plan (FYDP III), and sectoral policies.

Additionally, the analysis meeting sought to enhance synergy in the implementation of interdependent sectoral initiatives, reinforcing a collaborative approach to economic development.

Budget framework and key priorities

The FYDP III has proposed an 11.6 percent increase for the 2025/26 budget over the previous year’s, the minister for Finance, Dr Mwigulu Nchemba told Parliament on November 1, 2024.

This means Tanzania’s 2025/26 budget was supposed to rise to Sh55.06 trillion from Sh49.35 trillion of 2024/25.

However, presenting the 2025/26 budget proposals in Parliament on Tuesday, March 11 the minister for Finance, Dr Mwigulu Nchemba, said the government would table a Sh57.04 trillion budget in June due to overseen and unoverseen circumstances.

This expansion underscores the government’s commitment to strengthening the business environment, boosting economic growth, and ensuring fiscal sustainability.

A notable emphasis in the upcoming budget includes preparations for the 2025 General Election, as well as the settlement of arrears owed to contractors and service providers.

Furthermore, the domestic financing ratio is projected to remain above 70 per cent, reinforcing the government’s strategy to rely primarily on internal revenue sources to fund development initiatives.

The fiscal policy objectives guiding the budget framework include enhancing the investment climate to attract both local and foreign investors, supporting the growth of small and medium enterprises (SMEs), improving voluntary tax compliance, broadening the tax base, and streamlining levies and fees to foster economic efficiency.

Tax reforms and policy adjustments

The government has also prioritised tax reforms as a critical component of the fiscal agenda.

In line with this, the Task Force on Tax Reform started negotiations and deliberations since February 2025.

The task force will engage stakeholders from government agencies, the private sector, civil society, and academia to gather input and recommendations on refining the country’s tax regime.