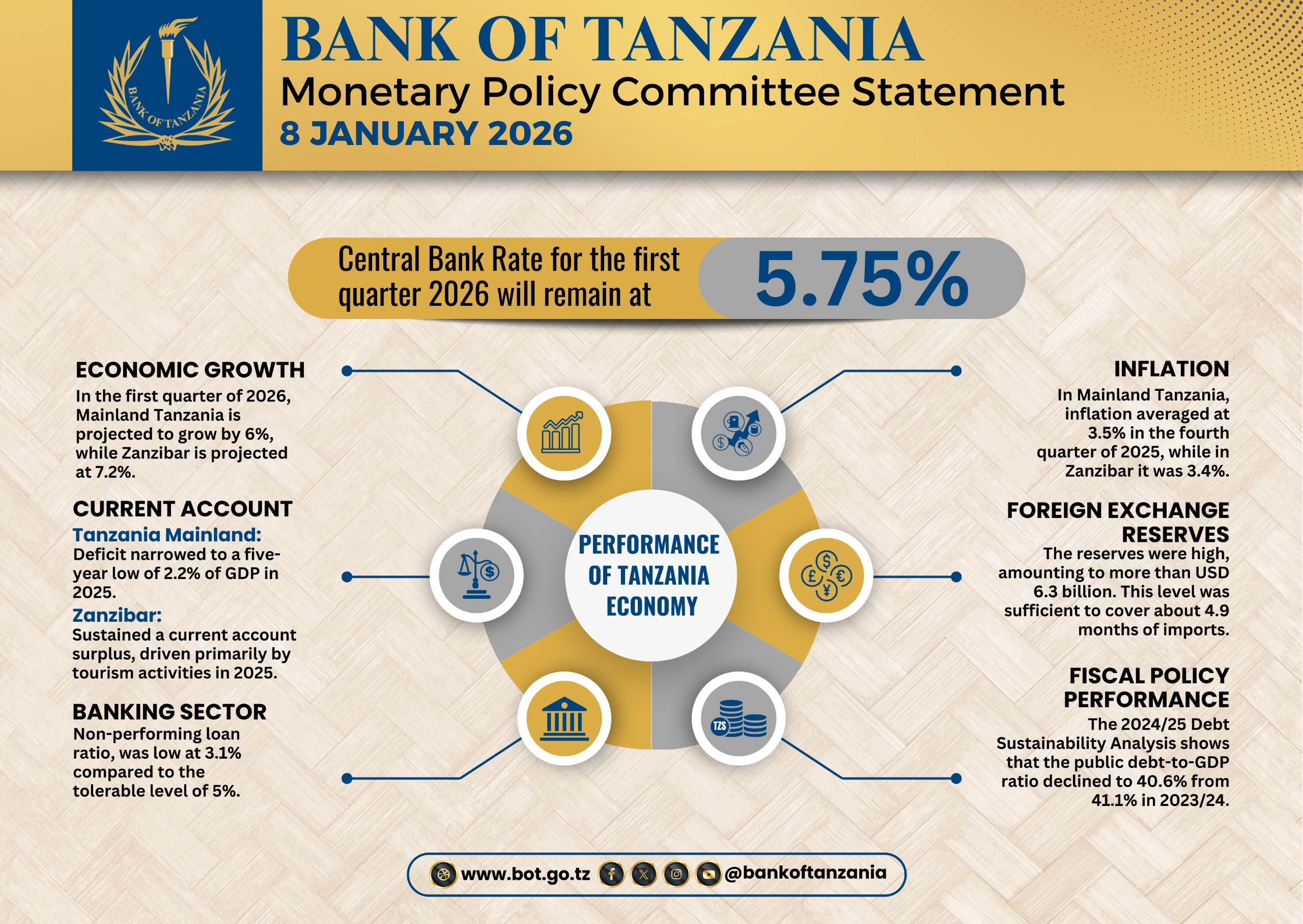

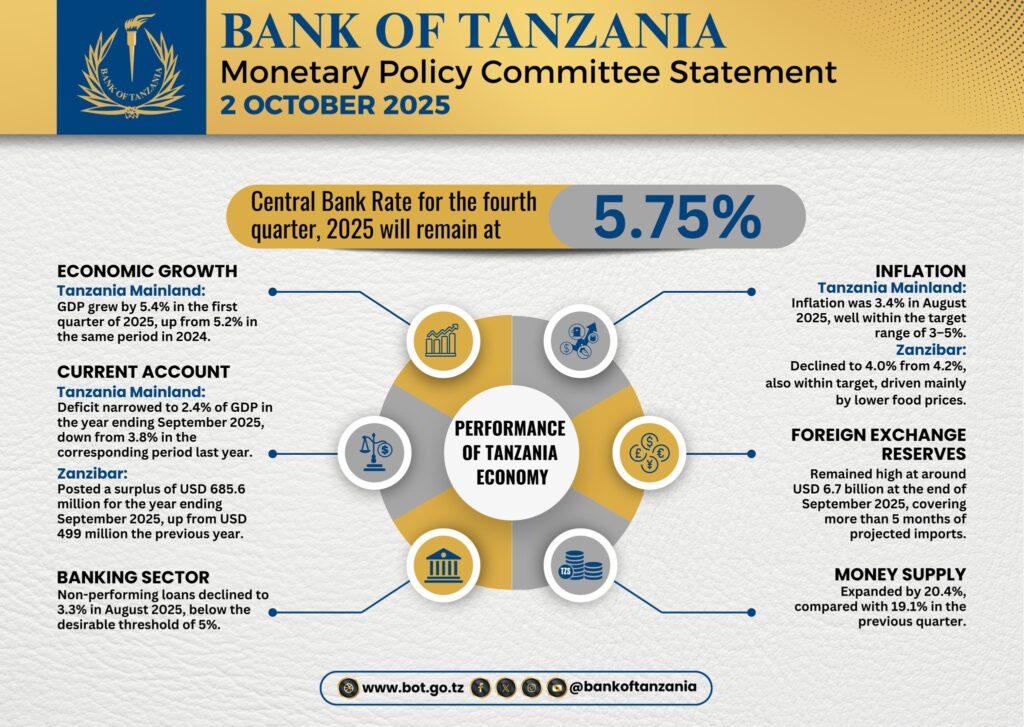

Dar es Salaam. The Bank of Tanzania (BoT) has retained the Central Bank Rate (CBR) at 5.75 per cent for the fourth quarter of 2025

Addressing members of the Tanzania Bankers Association (TBA) on Thursday October 2, 2025, the BoT Governor Mr Emmanuel Tutuba said the decision was reached at the Monetary Policy Committee (MPC) meeting convened on Wednesday, October 1.

Mr Tutuba disclosed that the MPC’s deliberations were guided principally by the continued anchoring of inflation within the Bank’s medium-term target range of 3–5 per cent.

“The stable inflation of between 3 and 5 per cent has been one of the drivers for the MPC’s decision,” he told banking executives, noting that recent data point to sustained price stability.

The BoT’s own published indicators show consumer inflation running comfortably within that band in recent months.

The governor added that the committee factored in improvements in the global economic outlook, citing signs of resilience in the third quarter and an expectation that the international economy will strengthen in the fourth quarter despite continuing geopolitical strains.

That external backdrop, together with domestic price stability, persuaded the MPC to maintain a steady monetary stance rather than tighten or loosen policy at this juncture.

The retained CBR sustains the level set in July, when the Bank lowered the rate to 5.75 per cent from 6.00 per cent, a move intended to support credit expansion and ease borrowing costs as inflationary pressures eased.

The July decision followed BoT forecasts that projected inflation remaining within the medium-term target and allowed some monetary space to support growth.

Bank treasuries and lenders, which monitor the 7-day interbank rate and the CBR corridor closely, will now assess the implications for lending spreads and liquidity management as the economy approaches the final quarter of the year.

The BoT’s market indicators show a 7-day interbank rate of around 5.65 per cent as at October 1, underscoring the relatively calm money-market conditions that accompanied the MPC’s decision.