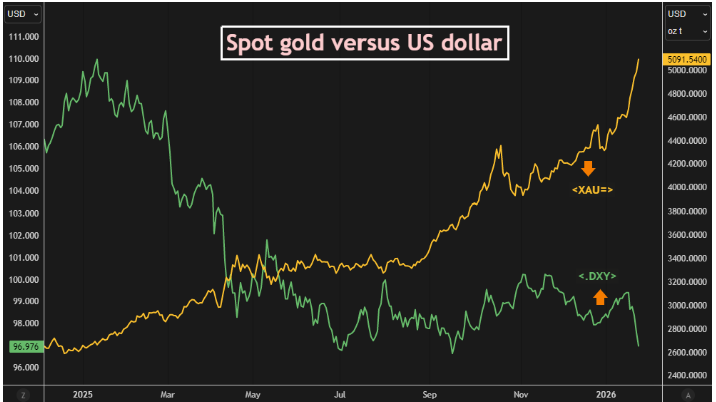

Sidney. Global prices of gold, silver and other precious metals have fallen sharply after global exchange operators tightened trading conditions, triggering widespread profit-taking and heightened volatility across metals markets.

Spot gold dropped more than 4 percent to about $4,355 per troy ounce in late afternoon trading on Monday, December 29, 2025, retreating from its recent peak of $4,565 reached on Friday, December 26.

Silver recorded even heavier losses, sliding nearly nine per cent to just above $73 an ounce after touching levels above $84 on Sunday, December 28.

Platinum and palladium prices also declined steeply over the same session, extending the downturn across the broader precious metals complex.

The immediate trigger for the sell-off was the CME Group’s decision to raise margin requirements for precious metals futures contracts, a measure that took effect on Monday, December 26.

Higher margin requirements oblige traders to deposit additional funds to maintain positions, particularly in contracts that allow for physical delivery.

Such moves are commonly deployed by exchange operators following sharp price rallies to limit excessive leverage and reduce the risk of disorderly trading conditions.

The CME action came after an exceptionally strong rally that had propelled precious metals to historic highs over the past week, reflecting a broader trend that has dominated markets throughout 2025.

Gold prices have risen around 65 per cent since the start of the year, while silver has gained roughly 150 per cent, placing both metals on track for their strongest annual performances since 1979.

Even after Monday’s retreat, precious metals have significantly outperformed major equity indices and cryptocurrencies over the year.

Market participants say the margin increase accelerated profit-taking that many investors had already been contemplating.

Some had expected selling pressure to emerge after the turn of the year to defer 2025 tax liabilities, but the higher cost of maintaining leveraged positions appears to have brought those decisions forward.

Louis Navellier, chief investment officer at Navellier & Associates, said the CME Group’s decision likely hastened the exit of short-term traders seeking to lock in gains.

Beyond exchange mechanics, the rally in precious metals has been underpinned by a combination of macroeconomic and geopolitical factors.

Persistent inflation concerns, heightened geopolitical tensions and uncertainty around global trade have encouraged investors to seek refuge in assets traditionally viewed as stores of value.

In parallel, the US Federal Reserve’s interest rate cuts have reduced the appeal of yield-bearing assets, further supporting demand for gold and silver.

The pullback has been particularly pronounced in palladium, a metal widely used in automotive catalysts, electronics and jewellery.

Palladium, which belongs to the platinum group of metals alongside platinum, rhodium and others, climbed to $2,023 on December 26, marking an 82 per cent rise for the year, before sliding to about $1,600 by December 30, a fall of roughly 21 per cent from its peak.

Many traders regard such a move as a market crash, especially given the speed and scale of the decline.

Developments in China have added to the pressure.

The Guangzhou Futures Exchange announced last week that it would adjust minimum daily opening positions and trading limits for some platinum and palladium futures contracts, with the changes taking effect on Monday.

Analysts say the Chinese measures, combined with the CME’s margin hike, reduced speculative appetite and amplified price swings in markets already thinned by holiday trading.

Silver and gold have also entered corrective phases.

A correction is typically defined as a fall of 10 per cent or more from a recent peak, a threshold silver has approached after briefly hitting record levels above $81.

Overnight trading saw silver retreat below $72.68, while gold slipped as much as 4.5 per cent to around $4,330 an ounce.

Despite these declines, both metals remain substantially higher for the year, underscoring the strength of the underlying trend.

Some analysts interpret the pullback as a healthy consolidation rather than a signal of deeper weakness.

Historical parallels have also been drawn with the late-1970s silver boom, which ended abruptly after exchanges raised margin requirements, culminating in the 1980 “Silver Thursday” crash.

Overall, the sharp decline in precious metals prices marks a significant inflection point after a year of extraordinary gains.

While the fundamental case for gold and silver remains intact for many investors, the latest developments highlight the sensitivity of metals markets to regulatory changes, speculative positioning and shifts in global risk sentiment.