Dodoma. The government has announced plans to increase budgetary expenditure by about 10.9 percent in the 2026/27 fiscal year as it presses ahead with the implementation of large-scale infrastructure projects and the expansion of social services.

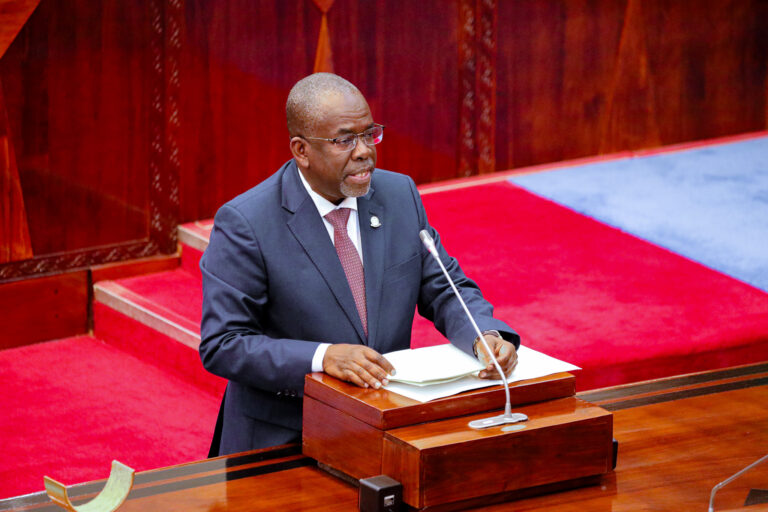

Presenting the Budget Preparation Guidelines and the Annual Development Plan for 2026/27 in Parliament on Monday, February 3, 2026, the minister for Finance, Mr Khamis Mussa Omar, explained that the proposed spending framework reflects the government’s determination to sustain economic momentum while laying a firm foundation for long-term growth.

“For the 2026/27 financial year, expenditure excluding repayment of government debt principal is estimated at Sh54.1 trillion, compared to Sh48.8 trillion in 2025/26, which is an increase of 10.9 per cent,” Mr Omar told the Parliament.

The projected expenditure will be financed under a proposed total budget of Sh61.93 trillion for 2026/27, representing an increase of about Sh5.4 trillion from the Sh56.49 trillion approved for the current 2025/26 financial year.

Mr Omar said the 2026/27 budget framework marks the first year of implementation of the Fourth Five-Year Development Plan (2026/27–2030/31), which seeks to accelerate economic transformation, raise productivity and strengthen competitiveness across key sectors of the economy.

According to Mr Omar, the plan targets the creation of about 1.7 million jobs by 2026, underpinned by strategic investments in infrastructure, human capital and productive sectors.

On the revenue side, the government expects to collect Sh46.69 trillion in 2026/27, of which tax revenue is projected at Sh36.89 trillion, while non-tax revenue is estimated at Sh9.24 trillion.

The latter figure includes Sh1.97 trillion expected to be raised by local government authorities. Grants from development partners are projected at Sh563.1 billion.

Mr Omar said the projected increase in revenue is anchored on favourable macroeconomic conditions and a range of measures aimed at strengthening domestic resource mobilisation.

These include promoting the use of information and communication technology systems in payments and revenue collection, tightening controls on tax exemptions, formalising the informal sector and improving the business and investment climate to unlock new revenue sources.

To bridge the financing gap, the government plans to borrow Sh15.24 trillion in 2026/27.

Of this amount, Sh7.41 trillion will be directed towards financing development projects, while Sh7.84 trillion will be used for repayment of maturing debt principal.

A significant share of expenditure will be devoted to recurrent obligations and priority public investments.

Mr Omar added that spending will include Sh9.69 trillion for public servants’ entitlements and pension contributions, Sh7.26 trillion for interest payments, Sh3.03 trillion for the acquisition of non-financial assets, and Sh22.91 trillion in subsidies to selected government institutions, public corporations and local government authorities.

He noted that the government’s expenditure management strategy focuses on ensuring efficient implementation of ongoing programmes and projects with quick and tangible results, while also building a solid base for broader economic reforms.

“The strategy emphasises aligning project implementation with national development plans to enhance the productivity of public resources, and strengthening monitoring and evaluation systems to ensure accountability and value for money in budget execution,” Mr Omar said.

Macroeconomic targets for 2026/27 include raising economic growth to 6.3 percent from a projected 5.9 per cent in 2025, maintaining inflation within a range of 3 to 5 percent, and increasing domestic revenue to 17.1 percent of gross domestic product (GDP).

The government also plans to prioritise the development of a competitive economy, investment in health and skills development, and the expansion of digital, energy and transport infrastructure.

Committee reactions

Meanwhile, the Parliamentary Budget Committee has drawn attention to the rising level of government debt while acknowledging that it remains within sustainable limits.

Presenting the committee’s views, its chairman, Mr Mashimba Mashauri Ndaki, said that by November 2025, Tanzania’s public debt stood at Sh109.01 trillion, representing an increase of 8.63 per cent from Sh100.35 trillion recorded over the same period in 2024.

He attributed the increase largely to borrowing undertaken to finance major infrastructure projects, including roads, railways, airports, electricity and water projects, as well as the disbursement of new loans.

“We are pleased to note that despite the increase, government debt remains sustainable in the medium term in line with international benchmarks,” Mr Ndaki said.

However, he said the committee had made several recommendations aimed at safeguarding fiscal sustainability.

These include boosting exports of goods and services to avoid breaching the 15 per cent threshold, and setting clear limits on the ratio of debt servicing to domestic revenue to ensure that repayments of maturing loans do not exceed 30 per cent of tax revenue.

The committee also reviewed budget implementation for the first half of the 2025/26 financial year, covering the period from July to November 2025. Mr Ndaki said the government collected a total of Sh22.88 trillion from domestic and external sources during the period, equivalent to 40.5 per cent of the annual target of Sh56.49 trillion.

Tax revenue amounted to Sh13.1 trillion, representing 38.4 per cent of the annual target of Sh34.1 trillion.

Over the same period, authorised expenditure totalled Sh22.94 trillion, also equivalent to 40.5 per cent of the approved 2025/26 budget of Sh56.5 trillion.

The resulting excess expenditure of Sh60 billion was financed through a short-term overdraft from the Bank of Tanzania, in accordance with Sections 34 and 35 of the Bank of Tanzania Act, Cap 197.

In light of these trends, Mr Ndaki said the committee had advised the government to further strengthen revenue collection by expanding the use of digital systems and promoting voluntary tax compliance to ensure that budget implementation targets are met.