Dar es Salaam. Small and Medium Enterprises (SMEs) in the country are set to gain from a new source of affordable financing following the launch of the Tanzania Commercial Bank’s (TCB) Stawi Bond, designed to mobilise local resources for business growth and financial inclusion.

The five-year bond, carrying a 13.5 per cent annual interest rate payable quarterly, enables Tanzanians to invest from as little as Sh500,000, offering secure returns to investors while providing TCB with fresh capital to extend credit to entrepreneurs and small traders.

Deputy Permanent Secretary in the Ministry of Finance, Mr Elijah Mwandumbya, represented Deputy Prime Minister and Minister of Minerals, Dr Doto Biteko, at the launch in Dar es Salaam on Wednesday, September 18. He said the bond widens opportunities for citizens to engage directly in national investment.

“This bond is more than a financial instrument; it creates a platform to enhance citizen participation in investment, promote financial inclusion, reduce reliance on foreign borrowing, and strengthen government revenues,” he said.

He commended TCB for its bold step, noting that the Stawi Bond reflects the bank’s commitment to offering innovative solutions to the country’s financial challenges.

The bond has received regulatory approval from the Capital Markets and Securities Authority (CMSA).

Chief Executive Officer Nicodemus Mkama described it as a milestone for Tanzania’s financial markets and a practical tool for SME empowerment.

“This is the first time a state-owned bank has issued such a bond, marking a major step under the Alternative Project Financing Strategy, which encourages public institutions to tap into capital markets rather than rely solely on budget allocations,” he said.

He noted that the value of the country’s capital markets rose by 75.25 per cent in the past four years, from Sh31.64 trillion in August 2021 to Sh55.45trillion by last month, showing resilience, innovation and growing investor confidence.

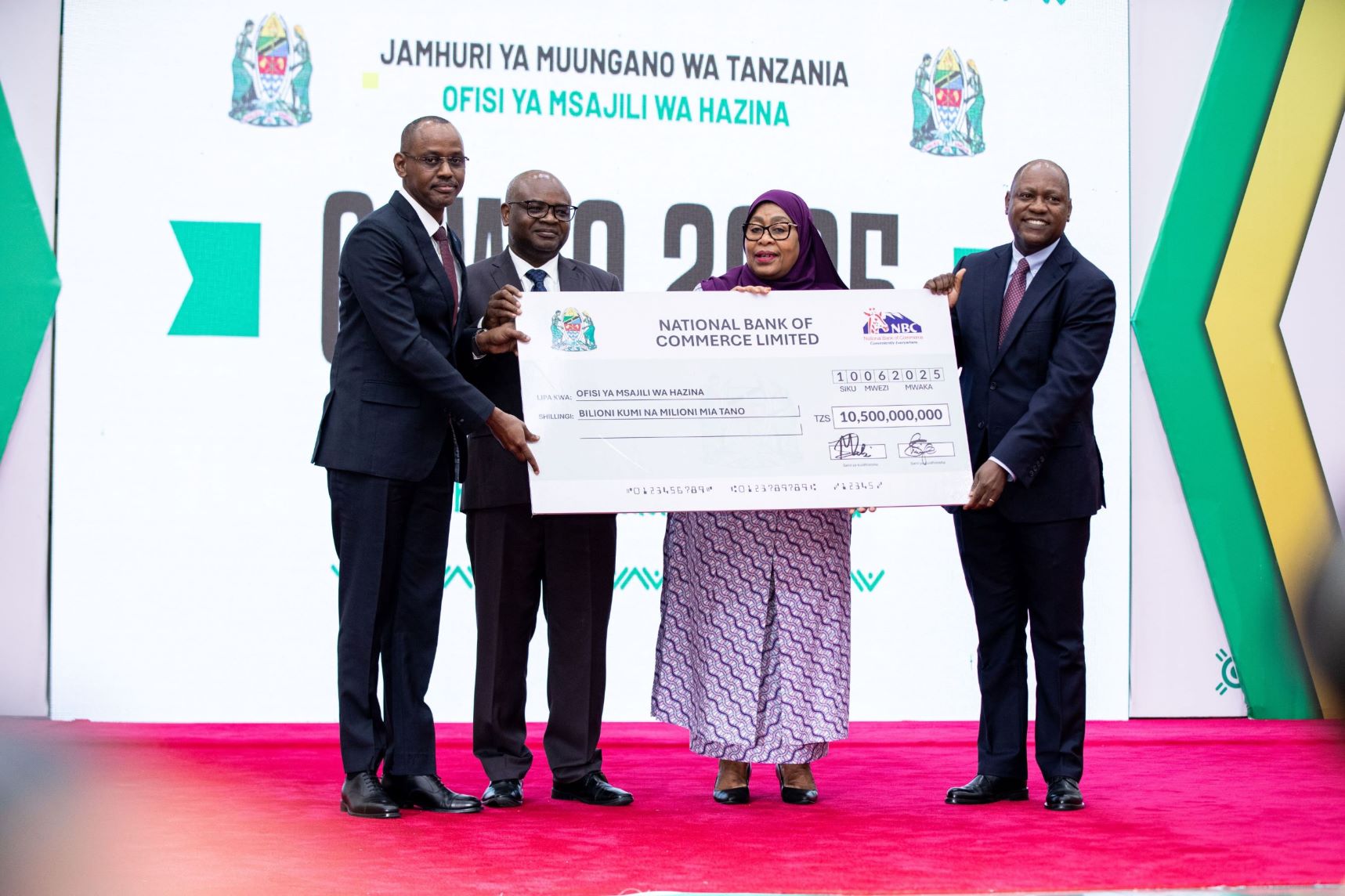

CMSA officially handed over the regulatory approval to TCB during the ceremony, signifying to investors that the bond meets all legal and market standards.

TCB’s managing director and chief executive officer, Adam Mihayo, said proceeds from the bond will expand SME financing, reduce dependence on costly foreign borrowing, and support low- and middle-income citizens with accessible loans.

“The Stawi Bond strengthens our ability to support small traders and entrepreneurs with affordable loans, while broadening financial inclusion for Tanzanians,” said Mr Mihayo.

The product also seeks to boost national income by directing local savings into productive sectors of the economy.

Dar es Salaam Stock Exchange (DSE) CEO, Peter Nalitolela, said investors can conveniently subscribe to the bond using both TCB and DSE mobile apps from anywhere in the country.

He urged Tanzanians, including private sector players, to seize the opportunity to invest and support SME financing through the securities market.

The initiative aligns with the Financial Sector Development Master Plan (2020/21–2029/30) and the National Economic Empowerment Policy, both of which aim to improve access to long-term financing and increase citizen participation in economic growth.

Additionally, through this bond, TCB will boost its liquidity and capital base, enabling it to serve more entrepreneurs and citizens while fostering inclusive economic development.